Payroll calculator smartasset

Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. Washington is one of seven states that do not collect a personal income tax.

Here S How Much Money You Take Home From A 75 000 Salary

When you start a new job and fill out a.

. Groceries and prescription drugs are exempt from the California sales tax. Try ezPaycheck 30-day FREE demo. Small Business Payroll Solution.

Amend a Payroll Report. However revenue lost to Washington by not having a personal income tax may be made up through other state-level taxes such as the Washington sales tax and the Washington property tax. If your health insurance premiums and retirement savings are deducted from your paycheck automatically then those deductions combined with payroll taxes can result in paychecks well below what you would get otherwise.

File No Payroll Reports. Print Paychecks in Minutes in House. Payroll Tax Definition.

Overview of Federal Taxes. Calculate Federal State Taxes. Oregon Payroll Reporting System 2022 Tax Rates The tax rates for Tax Schedule III are as follows.

Calculators Payroll Resources Small Business Insights Try Payroll Trial. Social Security and Medicare. Free Payroll Trial Menu.

Payroll taxes are part of the reason your take-home pay is different from your salary. Indiana State Tax Tables. Only the Federal Income Tax applies.

EzPaycheck Automates Indiana Payroll How to PrintReprint a Paycheck in House Last Minute W2 1099 Filing Solution Important Tax Due Dates 2022 Indiana State Tax Witholding Table 2021 Indiana State. Calculators Payroll Resources Small Business Insights. How to Use Secure Email.

The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844. Payroll Tax Help Center. Skip to main content.

California has 2558 special sales tax jurisdictions with local sales taxes in. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10. Washington has no state income tax.

When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Vjqbkwigxhsqqm

Hours Of Work Needed To Pay Rent In The 25 Largest Cities 2019 Edition Smartasset

Paycheck Tax Calculator Online 59 Off Www Wtashows Com

Harris County Tx Property Tax Calculator Smartasset

Smartasset Reviews Retirement Living

401 K Fee Disclosures Inadequate Gao Says Smartasset

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Vanguard Says Bonds Can Earn You Big Bucks What You Need To Know

Tax Calculator For Paycheck Store 52 Off Www Wtashows Com

Understanding Payroll Taxes And Who Pays Them Smartasset

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

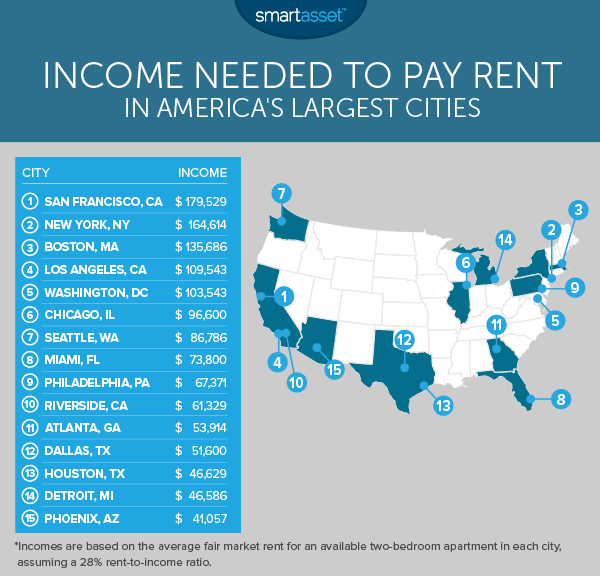

Income Needed To Pay Rent In The Largest U S Cities Smartasset

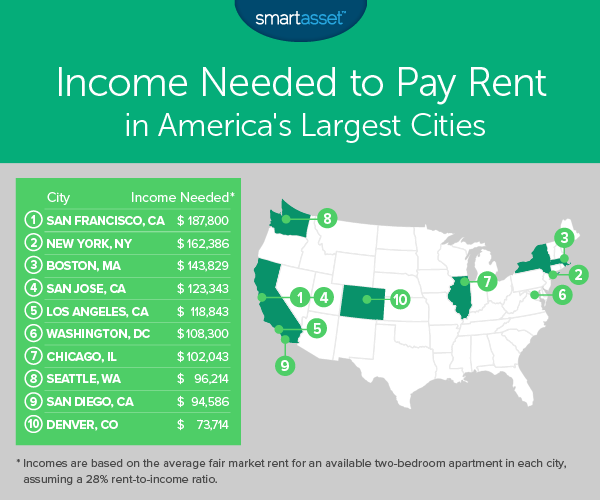

Income Needed To Pay Rent In The Largest U S Cities 2018 Edition Smartasset

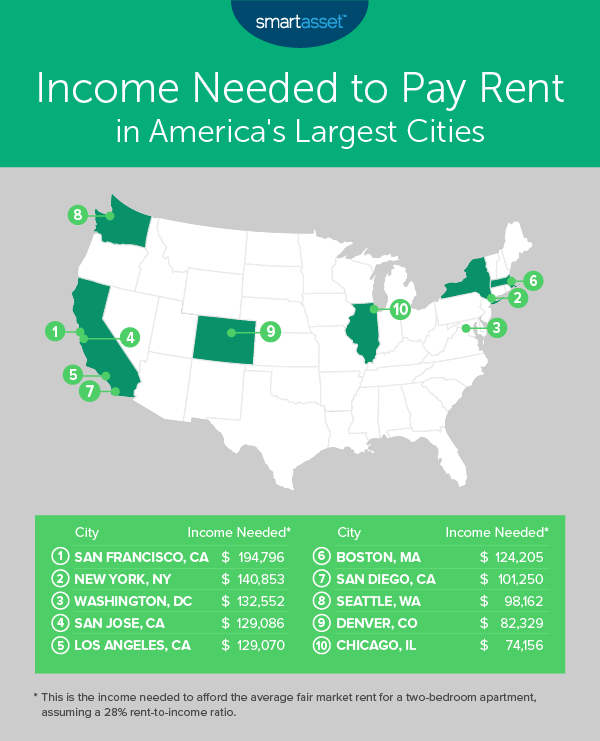

Income Needed To Pay Rent In The Largest U S Cities 2020 Edition Smartasset

New York Paycheck Calculator Smartasset

What It Takes To Be In The 1 By State 2022 Study Smartasset