Capital gains calculator with depreciation

Federal tax rate on depreciation recapture. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

While most investors are often the most concerned about capital gains depreciation recapture is actually the first tax bill you have to pay when you sell an investment property.

. When selling a primary home the seller generally doesnt have to worry about paying taxes on profits up to a certain pointThe IRS allows a single-filer homeowner to forgo paying taxes on up to 250000 gained from the sale and a married couple can exclude up to 500000 in profit. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. State Income Tax Note 5 Example rate is for Virginia Tax Rate 575 x Line 9.

Selling a second home vs. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. So for 2022 the maximum you could pay for short-term capital gains on rental property is 37.

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. If Land or house property is held for 36 months or less 24 months or less wef. Ideal for stocks cryptocurrency home refinancing and more.

Selling a primary residence. Check e-file status refund tracker. How Does Capital Gains Tax Work.

Capital Gains Tax on Profit See Note 6 Adj Selling Price less Adj Cost Basis 310000 x 15. Add the 38 medicare tax on net investments income if applicable Including recapture of. The general depreciation rules set the amounts capital allowances that can be claimed based on the assets effective life.

Please enter 0 for all unused fields. State tax rate on total gain. Property you are selling.

Is There a Way to Avoid It. Federal tax on capital gains. Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized.

R 60 000 x 40 R 24 000 is added to Sarahs taxable income and will be taxed at her marginal rate of tax. Here is a capital gains calculator to illustrate potential taxes if you sell your property rather than exchange. The capital gain on this home is 63000.

The calculator below will show the approximate capital gains tax deferred by an individual taxpayer when performing an IRC Section 1031 exchange. This lets us find the most appropriate writer for any type of assignment. Or it has no foundation below ground.

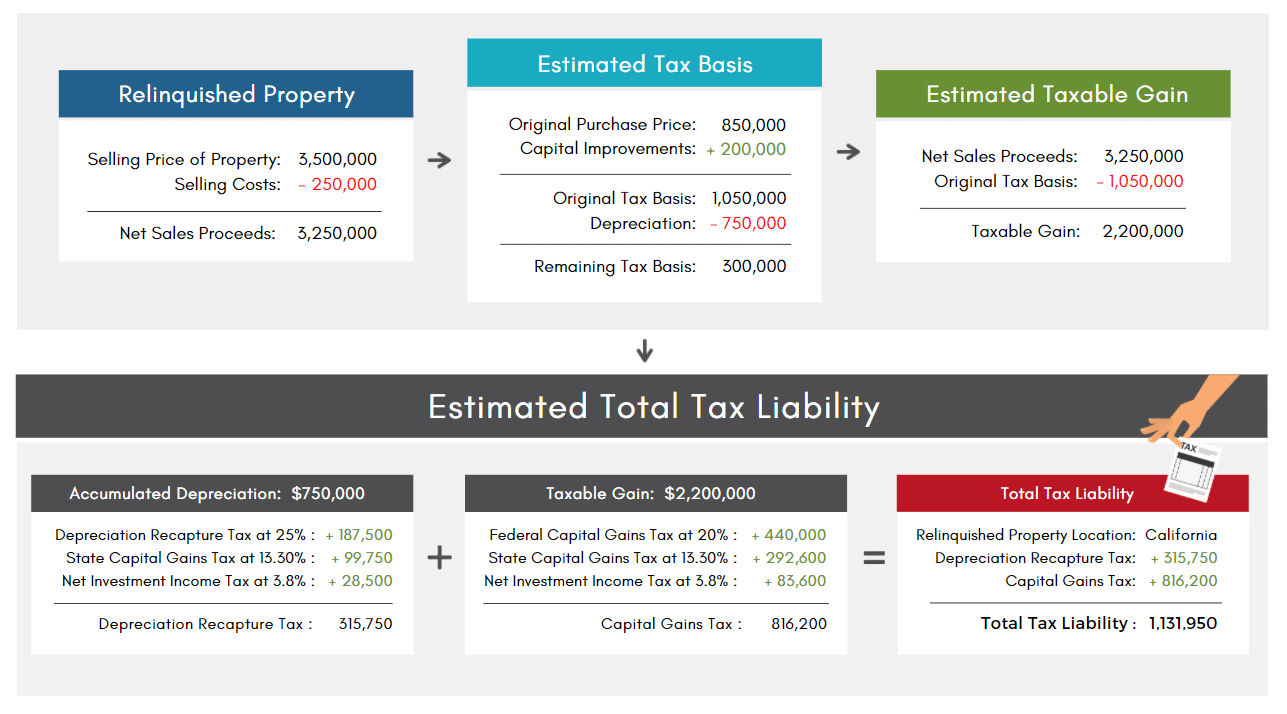

While most investors are more concerned about capital gains this example shows how depreciation recapture can account for much more of an investors tax bill than capital gains. What Is Capital Gains Tax. That tax is called capital gains tax.

Read about the primary ways in which an investor can legally avoid capital gain taxes. Depreciation recapture is assessed when the sale price of an asset. However this may not be the amount that is owed in taxes.

The Capital Gains Exclusion If you profit off the sale of your home you can exclude the first 250000 of that profit from taxes. These include the 1031 721 1033 tax-deferred real estate exchanges Deferred Sales Trust DST and various tax write-offs and credits. Recapture of all Section 1250 depreciation allowed see Note 4 45000 x 25 11250.

Capital gains and losses are classified as long-term or short-term. When you sell a capital asset the difference between the purchase price of the asset and the amount you sell it for is a capital gain or a capital loss. This means that 40 of the gain ie.

Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. The calculator based on your input calculates both short-term capital gains as well as long-term capital gains tax. If you bought a single share of stock for 100 your basis is 100.

The inclusion rate for capital gains is 40 for individuals. In this scenario the investor pays 75000 in depreciation recapture 25 of 300000 and 50000 in capital gains taxes 20 of 250000. Furniture appliances and tools costing 500 or more per tool some fixtures machinery.

Weve got all the 2021 and 2022 capital gains tax rates in one. Most investment property can be depreciated over. 370000 - 307000 63000.

A taxpayer reports their capital gains on Schedule D of Form 1040. R 24 000 x 39. Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property.

If we assume her marginal tax rate is 39 then approximately R 9 360 capital gains tax will be payable ie. Total Tax if the property is sold. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married.

General depreciation rules capital allowances. The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year. This calculator only calculates capital gains for the sale of Canadian assets and assets in countries with whom Canada does not have a tax treaty.

Below is more information about the capital gains tax and how to use this calculator. Class 6 enjoys a capital cost depreciation rate of 10. Calculated on capital gains less depreciation.

Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most significant one being the family homeRollover provisions apply to some disposals one of the most significant of which are transfers to beneficiaries on death so that the CGT is not a quasi. Also helps you calculate capital gainslosses and even set up new rentals and report depreciation. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Now we can calculate the capital gain. Capital Gains Tax. Ayuda disponible en Español.

You owe taxes on that 10 when you sell. 5 Financial Planning Mistakes That Cost You Big-Time and what to do instead Explained in 5 Free Video Lessons. The IRS tax code has something called section 121 which allows primary residence homeowners to exclude a certain amount of gains on the sale of.

The table below breaks down 2022 short-term capital gains tax rates by filing status. For married couples filing jointly that number increases to. Capital gains taxes and depreciation recapture taxes can be deferred indefinitely through the use of such exchanges.

If it then increased in value to 110 your capital gain would be 10. FY 2017-18 then that Asset is treated as Short Term Capital Asset. Apart from federal income tax the capital gains calculator also.

To calculate your depreciation deduction for most assets you apply the general depreciation rules unless youre eligible to use instant asset write-off or simplified depreciation for small business.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Tax Shield Formula And Calculator Excel Template

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

Depreciation Schedule Formula And Calculator Excel Template

Selling Your Investment Property How To Calculate Your Tax Liability

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Like Kind Exchanges Of Real Property Journal Of Accountancy

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Calculator For Home Office Internal Revenue Code Simplified

San Diego Capital Gains Tax On Rental Property In 2022 Mortgage Loans Rental Property San Diego Real Estate

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Chh1xbeol4bihm

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified