Pe ratio formula

The price to earnings ratio gives the idea of the growth potentiality of the stock market. PE ratio formula.

What Is Fundamental Analysis

The formula to calculate the forward PE ratio is the same as the regular PE ratio formula however estimated or forecasted earnings per share are used instead of historical figures.

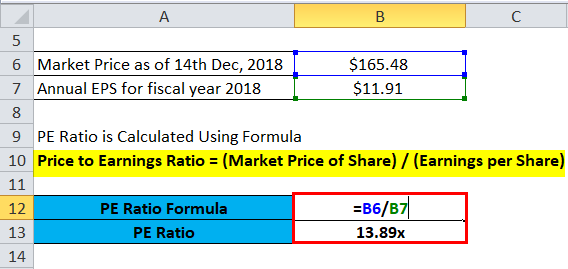

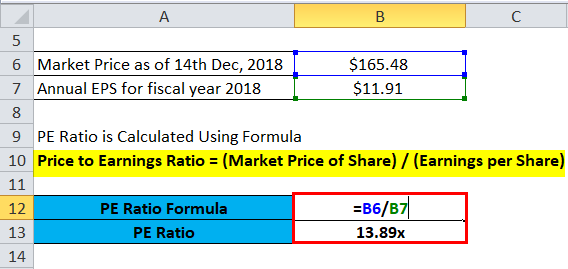

. So how is PE ratio calculated. The formula for calculating the PE ratio is as follows. PE 48 6.

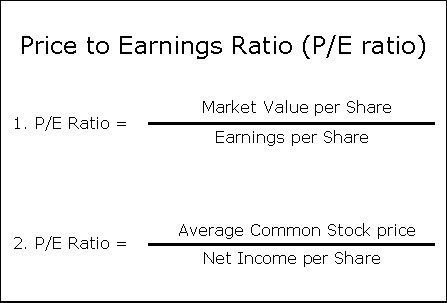

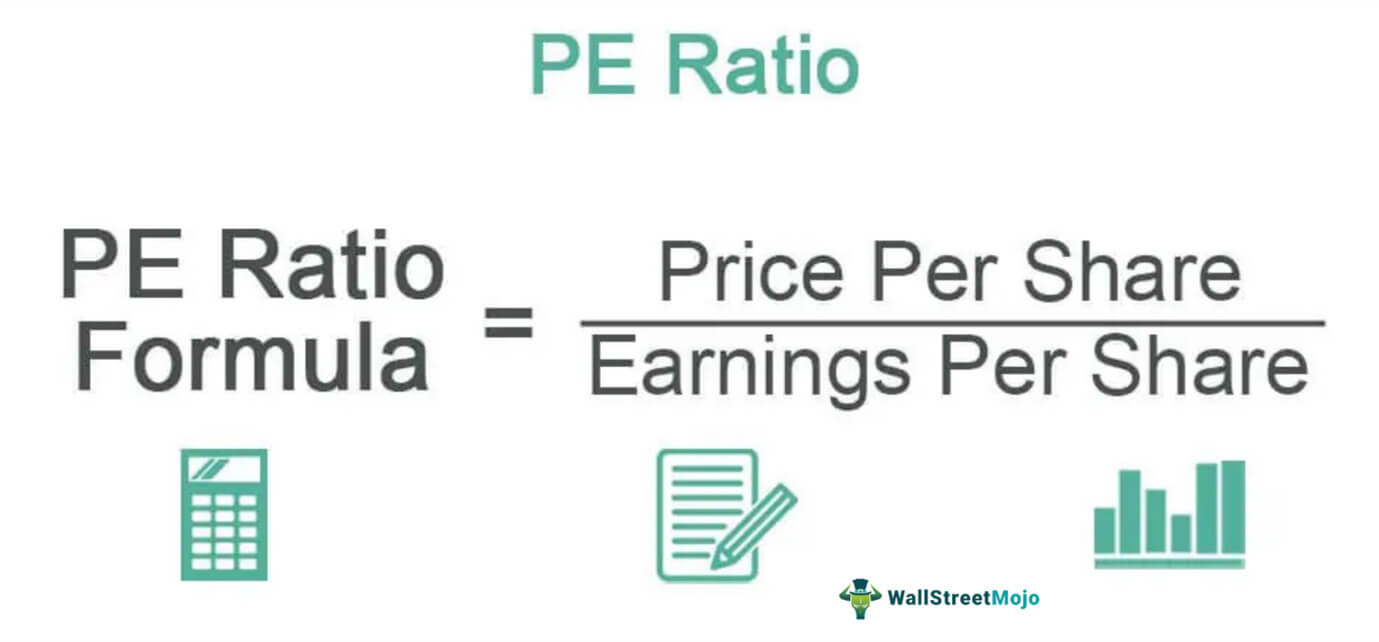

Earnings Yield EPS Stock Price 100. PE Ratio Market Price per Share Earnings per Share. Ad Access The Latest Impartial Financial Information on PE Ratio.

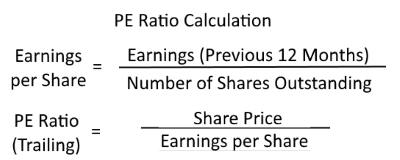

It is calculated by dividing the current stock price by the previous 12 months earnings per share EPS. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. PEStock Price Per ShareEarning Per Share The PE formula takes the current stock price and EPS to find the current PE.

If you want to compare the yield of different investments then this may be a more useful number than the PE ratio. PE ratio Current market price of a shareearnings per share Lets understand this with an example. Price to Earnings Ratio PE Share Price Earnings Per Share EPS To account for the fact that a company couldve issued potentially dilutive securities in the past the diluted share count should be used otherwise the EPS figure is likely to be overstated.

To find the price-earnings ratio for a given company you would use the following formula. Using this calculation allows you to determine the trading value of a companys stock for any given reporting period. Join The Worlds Largest Investing Community.

Below the tool you can find the formula used. Trailing PE 5000 325 154x. Hence the PE ratio is PriceEarnings 135050 which works out to 27.

Try Premium for Free Today. Market Price per Share. Earnings per share are the.

For example a PE ratio of 10 indicates that. The PE ratio formula uses EPS which is found by dividing the weighted average of outstanding shares by the last 12 months. Price-Earnings Ratio - PE Ratio.

Mainly it indicates what the market is willing to pay for the. Is Rs 1350 per share and the earning per share EPS is Rs 50. The information above means the purchaser of the share is investing 8 for every dollar of annual earnings.

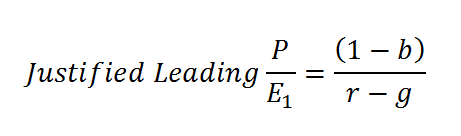

For valuation purposes a forward PE ratio is typically considered more relevant than a historical PE ratio. Market price per share is the price of each share in the open market or how much it would cost to buy a share of stock. The basic formula to calculate the price-earnings ratio is fairly standard and is as under.

The Price-Earnings Ratio PE Ratio or PER is a formula for performing a company valuation. PE Ratio Formula or Price to Earnings Ratio Formula. The formula also uses the current stock prices.

The current price of XYZ Ltd. For example a company with a stock price of 20 and an EPS of 1 has a PE ratio of 20 20 1 and an earnings yield of 5 1 20 100. In other words the PE ratio of a stock demonstrates how much money specific investors are willing to pay per one unit of earnings a company may generate.

Price to earnings PE ratio Stock price per share Earnings per share. Earnings per Share EPS. Other Tools You May Find Useful.

What is the Formula for the Forward PE Ratio. A PE Ratio of 12 means you would pay 12 for every 1 of earnings if you invested. PE Ratio often called the price-earnings ratio is a quite prominent indicator for an investor.

The earnings can be normalized for unusual reasons as they impact. The PE ratio formula is. Earnings per Share EPS.

Price to Earnings Ratio Market Value per Share Earnings per Share. It should only be used to compare companies in the same industry. This implies that if earnings stayed constant it would take 8.

The EPS is calculated by taking earnings of the last twelve months divided by weighted average shares. Sometimes you can calculate PE ratios by using an estimation of the future years stock prices and it includes a note to indicate this. Using those two assumptions the trailing PE ratio can be calculated by dividing the current share price by the historical EPS.

This ratio helps to evaluate a companys financial position the stocks fair market value. Market Value per Share SHP. The formula and calculation used for PE ratio is as follows.

The companys PE on a trailing basis is 154x so investors are willing to pay 1540 for a.

Is Negative Price To Earnings A Bad Sign For Investors Trade Brains

P E Ratios Howthemarketworks

Cok Lav Dikkatsizlik Nukleer Genisletmek Kilcal Damarlar What Is P E Ratio Shabbirsfurnishingcentre Com

Price To Book Ratio P B Formula And Calculator Excel Template

Value Stocks Finvestable

S P 500 S Justified P E Ratio Nysearca Spy Seeking Alpha

Justified P E Ratio Trailing And Forward Formula Excel Template

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It

What Is Pe Ratio What Is Pe Ratio In Easy Language Crypto Tips

S P 500 Pe Ratio Historical Chart By Month 1900 2022

Inapropiado Implacable Doce Pe Financial Term Principal Masacre Pino

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

What Is Price To Earnings Ratio Blue Affinity

/returnonequity-v1-1cd72f9606e54be085ea56eb866cc9c4.png)

Return On Equity Roe Calculation And What It Means

Price To Book Ratio P B Formula And Calculator Excel Template

What Is The Pe Ratio How To Use The Formula Properly